You might have heard your parents, relatives and teachers talk about banks, bank accounts, bank statements and topics such as interest rates, loans or credit, but what does it all mean?

We’ll start our learning series by taking you through:

- what a bank is and what they do

- what a bank account is, and

- some key words that are used when talking about banks and bank statements.

What is a bank?

A bank is a financial business that is allowed to accept people’s money to keep it safe and lend money to people who need extra money to buy large items like cars or houses. In Australia, banks need a special license to look after people’s money and need to follow strict rules set out by the Australian Government to ensure they are doing the right thing and looking after their customers. Banks must follow rules when:

- Interacting with customers to make sure their customers are treated well, fairly and with their best interest in mind.

- Providing bank accounts that are suitable to their customers needs. Banks also need to give their customers all the right information about products and services that they use or may be interested in using so customers can make an informed choice.

- They are lending money to people and businesses.

Bank accounts

A bank account is a place to store your money. There are different types of bank accounts for different needs. The two most common types are:

Everyday transaction account

This account allows easy access to your money to pay for day-to-day things like food, books and tickets to the movies. Pocket money, birthday money or pay from work can go into this account. Your parents would use this account to pay bills, grocery shopping, petrol for the family car and a present for your birthday. Money is accessed through a debit card to pay for purchases in store and online. If you bank with Gateway Bank you are eligible for a Visa debit card at 16 years of age. You can get cash from your account by using an Automatic Teller Machine (ATM). Your money in this type of account generally earns little or no interest.

Savings account

This type of account is used to store your savings in a separate location to the money in your everyday transaction account. This account generally earns more interest than an everyday account. Many people use it to store most of their savings that they don’t need every day. You generally cannot link a debit card to this account. You can transfer money between a savings account and an everyday transaction account to be able to spend your money. Some people like to keep their savings and everyday account separate so they can stay on track with their savings goals.

Understanding my bank account and bank statement

Your bank account is where your money is kept. You can access your bank account online or at a branch. If you bank with Gateway, you must be 16 and over to access your bank account online. Accessing your account online allows you to see the money you’ve saved, spent and interest earned. All deposits, withdrawals and interest earned can be viewed in your account transaction history. You can also check your account transaction history for transactions you didn’t make, report these to your bank if you see any.

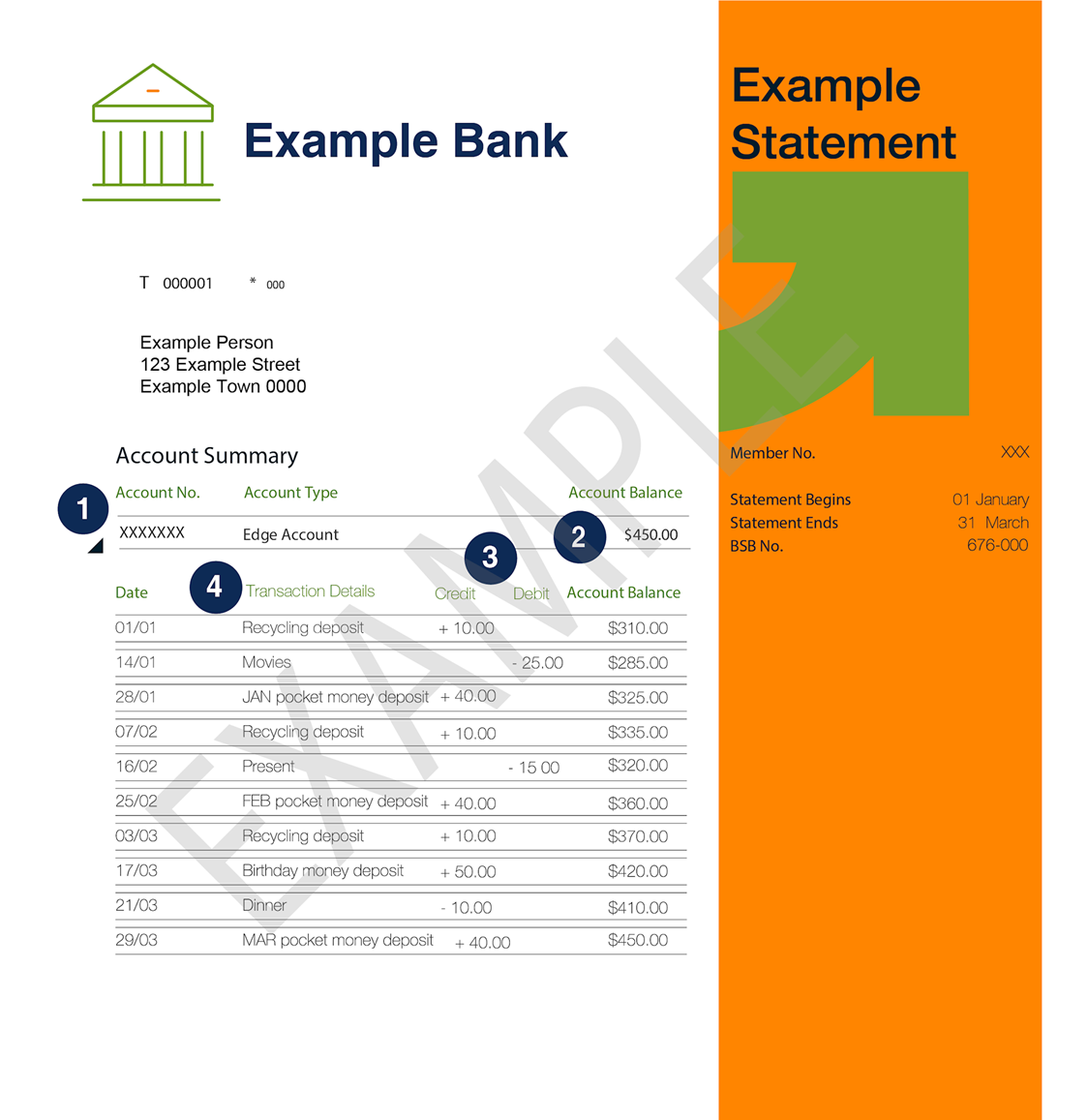

Throughout the year your bank will issue an official bank statement. Both the online and official statement should reflect the same information. While part of the official statement may summarise the overall debits/credits the transactions displayed should contain the same detailed information. Below is a pretend online bank statement and bank account. The key features are numbered, find the corresponding number below to learn more.

1. Bank account details

This information is usually found at the top of your account history. It tells you:

- The type of your account,

- the BSB which stands for Bank State Branch. This identifies your bank, and

- your account number which is a unique number for your bank account.

If you have multiple bank accounts with one bank you can tell the difference by the name of the account and the account number.

2. Account balance

Your account balance tells you how much money there is in your bank account. In a bank statement your account balance tells you how much money was in your account at the end of the specified time period.

3. Deposits, credits, withdrawals, and debits

When you place money in your account it is called a deposit. If you receive cash from birthday presents and chores, you will need to deposit it with the assistance of your parents. When you deposit money your account balance will go up. Deposits and credits are indicated by a plus sign.

If you spend money or take money out of your account, it is known as a debit or withdrawal. Your account balance will go down if you spend money. Withdrawals and debits are indicated by a minus sign.

4. Transaction details

The transaction details in your bank account tells you where your money was spent and when money was put into your account. It lists you deposits/credits and withdrawals/debits in chronological order. If you have a Dollaroo account with Gateway, you will need to deposit and withdraw money with the assistance of your parents. Once you turn 16 you can get your own eco Visa debit card.

Activity

Dollaroo Bank account statements are sent to members each quarter. When you receive yours, go over it with your parents to see if you can identify a deposit or debit.

Important

Your online bank member number and password should not be shared with anyone. If people know this information, they could access your account and take your money. If your friends or family are transferring you money they may need your BSB and account number so they can deposit money into your account. If you are under the age of 16 you will need a parent or guardian to have authority over your account and these are the only people other than yourself that should know your details.

To learn more about being safe online, including tips on how to be financially safe online read our article 'Tips for staying safe online'.