Trick or Treat? The Scariest Money Mistakes

With Halloween about to creep up on us, it’s the perfect time to think about the money matters that spook us the most.

We all know good financial management is important, but it can also be scary to face your finances, especially if you find it daunting and complex.

If you want to avoid a financial house of horrors, don’t make these scary money mistakes.

Breaking the budget

A budget is only useful if you stick to it. If you’ve gone to the trouble of working out where your money should be siphoned in any given month, it would be a shame not to put it into use.

If you don’t have a budget at all, then this is certainly a good place to start. Understanding the comings and goings of your finances is imperative to good money management. Remember, the aim of the game is simple; don’t spend more than you earn.

If you’re looking for a budget planner to help you get started, ASIC’s MoneySmart website offers a comprehensive calculator. You can save it online or export it, so you can come back and review/adjust frequently.

No savings buffer

Building your savings is essential. If you’re living paycheck to paycheck, you’re leaving yourself exposed. The trick is to set a regular savings schedule and keep it consistent. The amounts you contribute may vary depending on what you have available; just remember a little goes a long way so contributing even a small amount is better than nothing at all.

It can also be helpful to split savings into short-term and long-term accounts. Short-term savings can be used for items like a new car, a holiday, home renovations, etc. Whereas long-term savings might be a deposit for a house, and it can be kept in a high-bearing interest account like a term deposit.

Having wrong or outdated financial products

Many of us have different products and accounts when it comes to our finances – personal loans, home loans, credit cards, savings accounts, transactional accounts, insurance, superannuation, to name a few.

It can be hard to keep track of them all, which is why reviewing them regularly can be a tricky job. The fact of the matter is, our circumstances and the market changes but our financial products often stay the same. It’s worth doing a regular review of all the products and accounts you have to make sure they are still relevant. There might be better, newer ones out there. Or your current providers might be willing to give you a better deal if they know you’re scouring the market; it never hurts to ask.

If you want to compare products, try using a comparison website like Canstar, Mozo, RateCity or Finder.com.au.

Not understanding your home loan

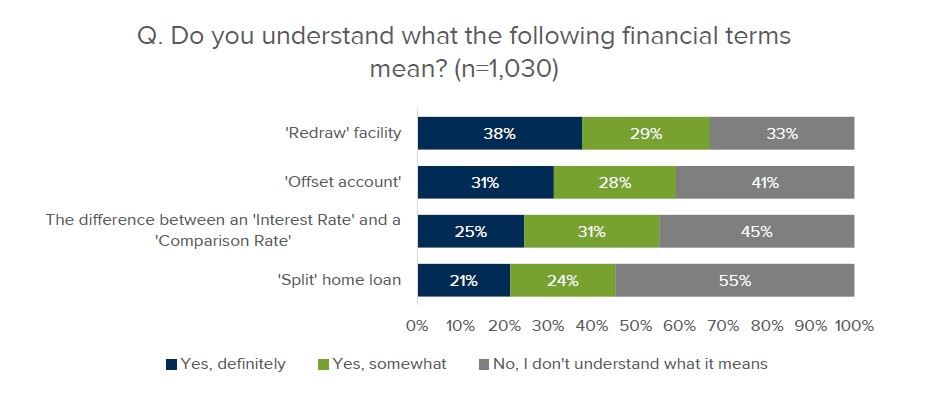

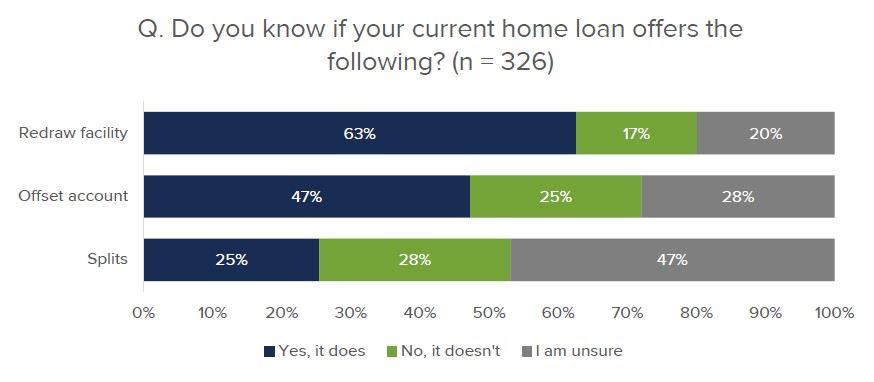

Our Mortgage Holders Sentiment Report 2017 revealed that many Australians worryingly did not understand what many of these common home loan terms mean.

In fact, when it came to their current home loan, many claimed they did not know what additional features were offered.

A home loan is one of the biggest financial commitments you’ll ever make. It’s worth taking time to do your research and gain a thorough understanding of what you’re getting. Apart from a great interest rate, there are plenty of additional features that you should consider.

Being under-insured

We never want the worst to happen but that doesn’t mean you shouldn’t plan for the worst. Leaving this to chance is a risky decision. When it comes to insurance, it’s worth taking a two-pronged approach.

First, you need to make sure you have all the relevant insurances for your circumstances. The main ones to consider include; home and contents insurance, car insurance, health insurance, Total and Permanent Disability insurance (TPD), income protection and life insurance.

Next, you need to make sure you have sufficient coverage. If your insurance doesn’t cover you fully it’s somewhat redundant. Be sure to speak to a professional adviser if you need help determining what is the appropriate cover for you.

Reviewing your insurance annually is a must. Your situation can change significantly over 12 months and you don’t want to get caught with outdated insurance.

Neglecting your retirement

Apart from the family home, superannuation will likely be one of the biggest assets you own. But it can be hard to plan for something so far into the future, especially when life gets in the way and current priorities take centre stage. Getting to post-work life and realising you don’t have enough superannuation can be extremely stressful. It’s time to stop taking a passive approach to your superannuation.

- There are simple ways to improve your future financial outlook;

- Consolidate your super accounts if you have more than one – this means you won’t be hit by multiple fees,

- Take advantage of tax concessions and salary sacrifice options and top up your balance with personal contributions,

- Get a check-up to ensure your investment option is the right one for you and the stage of life you’re in. For example, if you’re younger and at the start of your career you might decide to take a riskier long-term investment option, whereas if you’re close to retirement you might want to consider a safer option. This will depend on your individual circumstances and risk appetite.

Being over indebted

We will all have debt in some form or another throughout our lives. And true, there’s good debt (e.g. your mortgage) and bad debt (e.g. your credit card) but once we start down that track it can be a slippery slope.

Keeping debt in check doesn’t have to be difficult, there are simple ways to help manage your expenses. For instance, limit the amount of credit cards you have, if you don’t have automatic payments – set reminders in your calendar for when your repayments are due, pay more than the due amount if you can, and try consolidating your debt to make it easier to manage.